LEVERAGE RATIO The Leverage ratio is the way to indicate the risk factor of banks, if the leverage ratio is too high then the risk of the bank is high. There are certain percentage of the fall in earnings the banks can handle without distressing the health of the bank. The leverage ratio is asset to equity. After obtaining the leverage ratio then we can find by how much the fall in the earning banks can handle. The formula: Leverage = Asset / Equity Risk = 1 / Leverage Ratio Comparing the leverage ratio of 3 BanksBANK A 2015 $`000,000 Total Asset: 500,000 Total Liabilities: 350,000 Total Equity: 55,000 The Leverage Ratio: 500,000/55,000=9.91 Risk factor in falling of earnings: (1/9.91)x100=11% The Leverage ratio of Bank A is 9.91 and if Bank A has more than 11% fall in the earnings then the bank will be at risk. Bank A can bare up to 11% fall in the earnings. BANK B 2015 $`000,000 Total Asset: 400,000 Total Liabilities: 300,000 Total Equity: 35,000 The Leverage Ratio: 400,000/35,000=11.43 Risk factor in falling of earnings: (1/11.43)x100=8.75% The Leverage ratio of Bank B is 11.43 and if the earnings falls by more than 8.75% then the bank will be at risk. The high the risk factors in falling of earnings then better it is because that is the percentage in fall the banks can bare without going into financial distress. BANK C 2015 $`000,000 Total Asset: 350,000 Total Liabilities: 300,500 Total Equity: 50,000 The Leverage Ratio: 350,000/50,000=7 Risk factor in falling of earnings: (1/7)x100=14.3% The Leverage ratio of Bank C is 7 and if the earnings of Bank C falls by more than 14.3% then the bank will be at risk. ConclusionWhen we compare all three Banks the Bank C has the lowest leverage ratio which means the Bank C has the lowest risk of financial distress. Percentage of ownership

Will you get the 50 percent of the money that the company was sold?

Pay attention to new contracts

Conclusion and Suggestion Contracts between Venture Capital and Entrepreneur is among the key focus of many research academics in Finance. Most of the entrepreneurs ignore the importance of contract because they are so convinced that they will get 50 percent of the money that will be earned by the company. If you as an entrepreneur aware of exactly how much you will get when the company is sold in trade off or IPO then you will have no regrets. Venture Capital investors also tries their level best to avoid these kinds of misunderstanding because they cannot sell the company unless entrepreneur is fully agreed to sell when it is time to sell. For example if your company was sold for $30 million and you only get $2 million, you might not agree and destroy the contract. Transparency is important for Venture Capitalist and Entrepreneurs. Suggestion is to get a lawyer to have a look at it and explain the terms.

Investment partners with desire to spend on unnecessary things

Investment partners that cares only about profit

Investment partners that are not honest

Investment partners that devalues your abilities, ideas and contribution

Investment partners that has high ambition with less patience

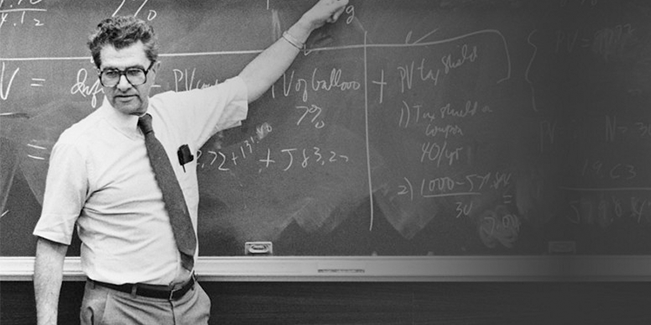

The modern capital structure was formed in 1958 by F. Modigliani and M. Miller, they were important contributors of capital structure in corporate finance. They proposed irrelevance theorem which means that it does not matter how the companies finance their capital. The main sources of companies that finance their capital is by issuing debt or equity. The debt can be obtained from Banks and equity is when the capital is raised by issuing shares or selling the stake of the company. The irrelevance theorem focused on the capital structure without tax, when there is tax it does matter on how the company finance their capital, which was published in 1963. Why capital structure is very important for investors?Every company pays tax which reduces the profit therefore companies would rather finance their capital by debt because debt is tax deductible and dividend payments are not. The investors should be aware of the capital structure of companies because it can be vital information on giving signals. Signals by Capital Structure

ConclusionIn conclusion on the ideal capital structure of company is always depends on the managers of the company. Increasing debt can increase the risk of company being bankrupt due to redirection in ability to payback their debt. To much of equity can also signal that the manager might not be motivated and instead they might use too much of the companies money for their personal use. They might also try to increase their equity by investing too much in new projects. It is best for the investors to learn corporate finance to understand how the corporate finance can increase or reduce the value of the company.

Dynamic Impact of Venture Capitalist on Financial Capital of Start-UpsVenture Capital (VC) is one of the way to finance the initial part of a business in return for equity. The venture capital companies invest in variate of ideas but mostly in technology because after the company becomes establish and when the big value is created the venture capitalists will have exit plan through Initial Public Offering (IPO) or trade sale. Usually the venture capital companies help to invest for up to 6 years and then list it on financial market for IPO to have large capital gain to pay of the shareholder with return. The venture capitalist have been the backbones of many great companies but there are also problems regarding the equity when the VC wants to exit.

Dynamic Impact of Venture Capitalist on Human Resources of Start-UpsStart-ups tends to grow fast and becomes large establish company with complex issues, that requires talented employees. The human resources becomes one of the issues of start-up companies, the technological start-up companies requires specific skilled employees. The venture capital companies are experienced in providing support with human capital to the start-up. The VCs will not only provide but they will also provide support with human capital. Dynamic Impact of Venture Capitalist on Sales and Marketing of Start-UpsThe start-up companies needs to reach curtain goal in terms of sales before it can be considered as established company to be listed as public in Financial Market. The entrepreneurs with ideas might only have technological background and they might not have the skills with marketing and sales, which is why it is essential that they have skilled manager to achieve the targeted goals. The Venture Capitalist provides support in terms of appointing Managers with great skills in sales and marketing. The managers with essential marketing skills that has critical, analytical and outside the box thinking to achieve the targeted goals of stat up company. The venture capitalist support with sales and marketing to achieve the goals faster to make their gains from the company when it is time to exit with IPO or Trade Sales. Dynamic impact of Venture Capitalist on Internal Organization of Start-upsAs the start up company grows it becomes complex and it requires organizational planning, the company needs to start putting all the things together in organized ways by creating departments and allocating the manpower accordingly. The company needs to make plans in terms of allocating departments for production, sale and marketing, Research and Development, human research department and board of directors. The entrepreneurs with the initial idea might not be the CEO of the company even that he owns up to half of the company's equity. There are some cases where the entrepreneurs might not be able to adopt to the CEO position to manage complex and establish company to add value. The venture capitalist and entrepreneurs might come to an agreement to appoint the CEO to add value to the company. Some people are just born to be a leader.

Dumb money is an investment that does not make a return. In business and in finance the dumb money is one of the biggest issue why investors lose their investments. When companies look for investors to invest in their company, then investors trust these investments but in the end the company fails and as well as the investments are lost. In corporate finance there is Venture Capital companies that invest in businesses, VCs can help entrepreneurs with great idea to make their dreams to come true. VCs also needs investors to invest in their Venture Capital company, if the normal investor invest in VC company then they might also invest an investment that does not make return. There are other factors when the company has too much money that they invest in wrong investment therefore it reduces the value of the company and these also one of the types of dumb money. There are 3 ways you can detect dumb money. Demand for transparencyBest ways to demand for transparency is by asking questions before you make your investments. The important questions are:

Detection of dumb investment by Venture CapitalistsThere are great entrepreneurs that knows how to build and fund the businesses, these entrepreneurs can convince the investment companies to invest in almost anything. The Venture Capital companies usually detect bad investment but even for them it is hard sometimes. One of the tactics used by entrepreneurs is that they wait for more than half a year before they start blowing the money. Waiting builds trust from VCs and then they get the 2nd payment from VC companies, usually it take long before entrepreneurs get the money. Venture Capitalist can usually detect this when the entrepreneurs present their proposal and during the interview by also asking the right questions. The VCs also wait before their invest in the business ideas of entrepreneurs until they see the response of other Venture Capitalist. Dumb money in established companiesIn corporate finance there is one of the complex issue but I will try to make it as simple as possible to explain it. The investors and shareholders do not want the company to have too much money which is called free cash but some call it dumb money. When established companies have too much extra money then they want to make investments which could be a bad investments. These usually can be detected by knowing the type of business and also the type of CEO or managers. The CEO with high ambitions are usually not favorable by the investors because they make too many investments that could lead to failure which will heart the value of the company. Always know the CEO of the company you want to invest. ConclusionThe person who holds the money has the power, it is the most important thing every investors should know. As soon as you let that money go then you transfer the power to other party. It is best to invest in investment that you know it will make a return in as short period of time as possible. The economy is always uncertain therefore sooner you make your return the better it is for you.

There are many capital markets around the world, and the procedures for listing a company is different in every market. Capital market is also a financial market where companies raise capital to finance their business. The companies must apply based on the business sector. It is also important that companies know which market they want to be listed and which market they can afford to be listed. With in capital market the are several different markets where companies can be listed, some of the markets can help companies to raise more capital but it can be costly and the requirements are more difficult. Stage 1, Preparation and submission First stage of listing a company is to prepare the documents and make proposal. Companies must make a proposal for Initial Public Offering (IPO). The companies must also know the documents required and prepare all the documents and prospectus for submission. Companies should submit all the documents and proposals when they are fully prepared. If it is first time the company is trying to be listed then it is most advisable to hire professionals to help with all the documents. This stage usually will take about 10 to 12 weeks depending on the country and market. Stage 2, The process of applicationIn the second stage companies will make public exposure of company prospectus, after that the regulators will ask for additional documents if required or comment on the prospectus. At the second stage the companies will also visit the company to make sure that the company is legit. Finally the regulators will evaluate and approve. This stage will take about 10 weeks but it could take more, depending on the regulators. Stage 3, Registration of prospectusCompanies will update their prospectus before registration and lodgement of prospectus. The companies will make all the necessary payments for registration. After this the companies will start making plans for marketing. The stage 3 takes about 5 weeks. Stage 4, Launching of prospectusInitial Public Offering will be made in this stage, the underwriters will set the best price to offer for IPO and the number of shares to offer. The underwriters are the investment companies or banks that buys or sponsors the shares from the company and sells it to the public as IPO. Usually this stages takes about 1 week to 2 weeks. Stage 5, Listing the companyAt the final stage the shares will be allocated according to the category, for example if the company is food production company then it will be listed accordingly. The trading will be live on capital market. The final stage can take from 2 to 3 weeks.

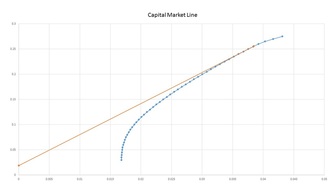

There are two types of bond market in some of the countries, such as primary and secondary bond market. There are also types of bond and one of the bond that I will be talking about is government bond and how it can help to control the inflation rate. Government usually produce bond to gain some capital to improve the economy, bond is very good way for government to generate capital for their investment, but it can be no use if the government spends on things that does not generate returns. Bond has maturity date and when the maturity date is expired the government must pay back the original price of bond. Usually bond has very little returns and the value of bond reduces when it gets closer to the maturity date. The reason why bond is bought by many people is because it is considered as risk free and it has coupon payment. Why the value of Bond reduces when it gets closer to due? www.livetradingnews.com www.livetradingnews.com The value of bond reduces as it gets closer to the due date, the reason is because the bond has a coupon payment. The coupon payments are usually made annually and the longer the maturity date of bond the longer the coupon payment will be. Lets say if a person has bond and it has maturity date of 10 years, that means he will receive coupon payments every year for 10 years. If there is another person who holds a bond with 5 years then this person will only get coupon payment of 5 years. It is better to be paid for 10 years rather than 5 years. It can also be proved by formula that the closer the maturity date the lower the value of bond. Why the price of bond fluctuates even that it is risk free asset?Bond is risk free asset in a long run, if the person that holds the bond does not sell their bond until the maturity then it is risk free. Usually the bond price fluctuates in the secondary market. Where bond is traded among the people, the value of bond usually dependent to the interest rate, because if the coupon payment of the bond that the customer is already holding is lower than the new coupon payment then the price of bond will reduce. The new buyers would rather buy bond that gives higher and longer maturity. Lets say there are two person John and Mike, if John has 1000 dollar worth of bond with 5 percent coupon payment and suddenly interest rate goes down, then the new coupon payment is 3 percent then Mike would be willing to buy the bond from John for higher price such as 1400 dollars. If the coupon payment goes up to 8 percent then Mike would rather buy new bond than buying Johns old bond with lower coupon payment and lower percentage. If Mike does want to buy the bond then he would buy it for less maybe for about 800 dollars or 600 dollars. The price of bond also fluctuates when the government wants to buy back their bonds or issue new bond. Therefore it is risk free in the sense that if you hold the bond until the maturity and also you can get coupon payment. Shares do not have maturity therefore you never know how much u will get after some years, but if you hold your bond until the maturity then you will get your money back. Bond is good for portfolio Capital Market Line Capital Market Line The investors will buy risk free asset like bond with their portfolio to reduce their risk by diversifying. It is not good to put all eggs in one basket therefore it is best to have a portfolio with multiple shares and risk free asset. Usually the investors will construct an efficient frontier by drawing capital market line, the portfolio will have number of shares with high risk and to minimize the risk they will also include risk free asset. It is one of the best ways to reduce risk in investment, it helps the diversify risk, if one 2 shares goes up and 3 goes down it reduces the risk of losing everything. |

AuthorEcon2u and others CategoriesArchives

July 2017

|

RSS Feed

RSS Feed