There are many capital markets around the world, and the procedures for listing a company is different in every market. Capital market is also a financial market where companies raise capital to finance their business. The companies must apply based on the business sector. It is also important that companies know which market they want to be listed and which market they can afford to be listed. With in capital market the are several different markets where companies can be listed, some of the markets can help companies to raise more capital but it can be costly and the requirements are more difficult. Stage 1, Preparation and submission First stage of listing a company is to prepare the documents and make proposal. Companies must make a proposal for Initial Public Offering (IPO). The companies must also know the documents required and prepare all the documents and prospectus for submission. Companies should submit all the documents and proposals when they are fully prepared. If it is first time the company is trying to be listed then it is most advisable to hire professionals to help with all the documents. This stage usually will take about 10 to 12 weeks depending on the country and market. Stage 2, The process of applicationIn the second stage companies will make public exposure of company prospectus, after that the regulators will ask for additional documents if required or comment on the prospectus. At the second stage the companies will also visit the company to make sure that the company is legit. Finally the regulators will evaluate and approve. This stage will take about 10 weeks but it could take more, depending on the regulators. Stage 3, Registration of prospectusCompanies will update their prospectus before registration and lodgement of prospectus. The companies will make all the necessary payments for registration. After this the companies will start making plans for marketing. The stage 3 takes about 5 weeks. Stage 4, Launching of prospectusInitial Public Offering will be made in this stage, the underwriters will set the best price to offer for IPO and the number of shares to offer. The underwriters are the investment companies or banks that buys or sponsors the shares from the company and sells it to the public as IPO. Usually this stages takes about 1 week to 2 weeks. Stage 5, Listing the companyAt the final stage the shares will be allocated according to the category, for example if the company is food production company then it will be listed accordingly. The trading will be live on capital market. The final stage can take from 2 to 3 weeks.

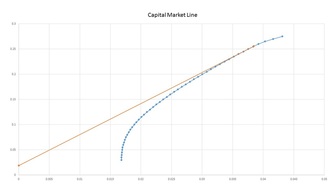

There are two types of bond market in some of the countries, such as primary and secondary bond market. There are also types of bond and one of the bond that I will be talking about is government bond and how it can help to control the inflation rate. Government usually produce bond to gain some capital to improve the economy, bond is very good way for government to generate capital for their investment, but it can be no use if the government spends on things that does not generate returns. Bond has maturity date and when the maturity date is expired the government must pay back the original price of bond. Usually bond has very little returns and the value of bond reduces when it gets closer to the maturity date. The reason why bond is bought by many people is because it is considered as risk free and it has coupon payment. Why the value of Bond reduces when it gets closer to due? www.livetradingnews.com www.livetradingnews.com The value of bond reduces as it gets closer to the due date, the reason is because the bond has a coupon payment. The coupon payments are usually made annually and the longer the maturity date of bond the longer the coupon payment will be. Lets say if a person has bond and it has maturity date of 10 years, that means he will receive coupon payments every year for 10 years. If there is another person who holds a bond with 5 years then this person will only get coupon payment of 5 years. It is better to be paid for 10 years rather than 5 years. It can also be proved by formula that the closer the maturity date the lower the value of bond. Why the price of bond fluctuates even that it is risk free asset?Bond is risk free asset in a long run, if the person that holds the bond does not sell their bond until the maturity then it is risk free. Usually the bond price fluctuates in the secondary market. Where bond is traded among the people, the value of bond usually dependent to the interest rate, because if the coupon payment of the bond that the customer is already holding is lower than the new coupon payment then the price of bond will reduce. The new buyers would rather buy bond that gives higher and longer maturity. Lets say there are two person John and Mike, if John has 1000 dollar worth of bond with 5 percent coupon payment and suddenly interest rate goes down, then the new coupon payment is 3 percent then Mike would be willing to buy the bond from John for higher price such as 1400 dollars. If the coupon payment goes up to 8 percent then Mike would rather buy new bond than buying Johns old bond with lower coupon payment and lower percentage. If Mike does want to buy the bond then he would buy it for less maybe for about 800 dollars or 600 dollars. The price of bond also fluctuates when the government wants to buy back their bonds or issue new bond. Therefore it is risk free in the sense that if you hold the bond until the maturity and also you can get coupon payment. Shares do not have maturity therefore you never know how much u will get after some years, but if you hold your bond until the maturity then you will get your money back. Bond is good for portfolio Capital Market Line Capital Market Line The investors will buy risk free asset like bond with their portfolio to reduce their risk by diversifying. It is not good to put all eggs in one basket therefore it is best to have a portfolio with multiple shares and risk free asset. Usually the investors will construct an efficient frontier by drawing capital market line, the portfolio will have number of shares with high risk and to minimize the risk they will also include risk free asset. It is one of the best ways to reduce risk in investment, it helps the diversify risk, if one 2 shares goes up and 3 goes down it reduces the risk of losing everything.  Before October 2008 the interest rate in US was high compared to after October the interest rate was below 1% and by November and December it was around 0.15%. If we look at the interest rate provided by US Federal Reserve, in 30th of September 2008 interest rate was 2.03 percent and 1st of October 2008 the interest rate was 1.15, if we look at the exchange rate provided by x-rates on 30th of September 2008, 1 Euro was 1.408 USD and 1 GBP was 1.7801 USD. On the 1st of October the exchange rates: 1 Euro was 1.405 USD and 1 GBP was 1.779 USD. During these two days the interest rate was not below 1 percent but there were some changes in USD. If we look at the interest rate on 2nd of October when the interest rate was 0.67 percent, 1 euro was 1.384 USD and 1 GBP was 1.764 USD. The US dollar got stronger by day in these three days, on the 3rd and 4th of October the interest rate was 1.1 percent and it increased compared to 2nd of October and 1 Euro was 1.381 and 1 GBP was 1.773 USD. We can see that USD got weaker to GBP and USD was stronger to Euro. It shows that some currencies respond towards the interest rate more efficiently compared to other currencies. Interest rate is one of the factors that can have impact on the USD but there are other factors that impacts on the exchange rate. According to US Federal Reserve, after 2009 the interest rates were below 0.2 percent, but the exchange rates during this year was very interesting. In March 1 Euro was 1.4178 USD but starting from April and by December 1 Euro was 1.621 USD. During this year USD got so much weaker even that interest rate was stable below 0.2. It shows that the interest rate have some impact only in short period of time, but in long period the exchange rates will depend on other factors. One of the other factor that influences is the price of oil. Another information I found interesting is the Foreign Exchange Data provided by New York Federal Reserve. They do not provide daily data, therefore it is hard to use this as an information to predict the future interest rates. In this Foreign Exchange Data they show how much of other currencies were bought and how much of USD was sold to other currencies to banks around the world. It would have been one of the best ways to know the exchange rates if the data was provided more frequently but the latest one is on 2013. It could have been predicted with Demand and Supply method. I suggest the best way to predict the future exchange rate would be watching the news, because the politics have great influence on the exchange rate. Exchange rate does not only depend on the US economy but it also depends on the economy of other countries. |

AuthorEcon2u and others CategoriesArchives

July 2017

|

RSS Feed

RSS Feed