Factors impact economic growth Factors impact economic growth The standard of the living of people in a country depends on the economy of that specific country with the influence of international economy. The economy is important for all the countries, therefore with the correct use of key economic factors most of the countries can have high economic growth. The resources of the earth are limited but the desires of the people are unlimited. According to Hyman.D.N (1986) economy is a study that allocates the resources among alternative uses. However there are some other similar definitions of economy, the two types of economy: which are microeconomic which focuses economic in details on the domestic economy and the macroeconomic which focuses on the economy of the entire country. The key economic factors that is important for a country depends on the macroeconomic situation of a country. The natural resources, human capital and foreign direct investment (FDI) are the key economic factors that are important for economic growth of a country. One method of showing how key economic factors can contribute to the growth of economy in a specific country is by comparing the relation of natural resources, human capital and foreign direct investment with gross domestic product (GDP) of that country in two different years. Impact of Foreign Direct Investment (FDI) to EconomyForeign direct investment is one of the key important factors which are important for economic growth. Foreign direct investment (FDI) is when a country encourages the companies from different countries to invest their capital, technology and skilled employees in their country. Foreign companies buy the local currency to invest in local economy, this increases the demand for local currency, which makes it stronger. Strength of currency is vital for the economic growth it helps to keep the inflation rate lower, and reduce the price of imported goods. It helps to increase the standard of living, most of the citizens can afford to buy imported goods at lower cost. However, there are disadvantages of FDI, the main issue is bankruptcy of local companies, and most of the local companies cannot compete with the foreign companies due to the cost and efficiency of production. Foreign companies have more capital and technology to reduce the cost of production, therefore they can reduce the price of goods they sell to the public. Local companies do not have the technology and capital to produce in mass production and due to these reasons they cannot reduce the cost of production. However, government implement’s barriers to protect the local companies from bankruptcy. The major government policy is an increase in tax for foreign companies. An increase in tax forces the foreign companies to raise the price of goods they sell. Impact of Human Capital to EconomyOne of the main goals of economy of a country is to minimize the unemployment rate. The human capital is important for the companies to maximize the production at minimum cost. The productivity of employees depends on the education and experience, therefore the governments try to improve the quality of the education. The education is the biggest contributor for the human capital. The education prepares the students to become valuable employees and in return the employees increase production of goods in the country. Another factor that contributes to the human capital is the foreign direct investment. However, according to Soboleva (2011) there are two situations when human capital is undervalued or overvalued. An undervalued employee situation accurse when the employees perform low skilled works. The overvalued accurse when the employees are given jobs to perform that are beyond their capability. These two situations are common issues of human capital in an economy. An increasing globalized economy, these issues decreased dramatically and in return it created opportunities in international market (Soboleva 2011). ConclusionIn conclusion, the economy is becoming more internationalized, the economy of one country has big impact on the economy of another country. It is important to have good relationship with other countries to maintain stable economy.

www.express.co.uk www.express.co.uk On Monday Pound Sterling went down to 1.41 against US dollar, after announcing of Boris Johnson that he wants to campaign to leave EU on Sunday 21st of February. This is not something new and it was predicted that Boris Johnson would campaign for UK to leave European Union. People were aware of it for a while but yet the market did not respond to it as it did on Monday 22nd of February. Efficient Market HypothesisIn the last 30 years of last century, efficient market theory has been widely accepted and dominant in academic finance and economics. It is linked with “random walk”. According to Osborne (1964), the change of all stock prices is random and unpredictable. Because stock prices and exchange rates fully reflect all the information, if the information is changed, stock prices and exchange rates will immediately reflect the news. However, this information cannot be known in advance, the situation leads investors not to depend on previous stock prices and exchange rates to predict future prices and rates. Followed in 1965 and 1970, Eugene Fama for the first time mentioned the concept of efficient market. He made some assumptions that in the efficient market, there are a large number of rational investors who expect to obtain maximize returns. Every investor is able to acquire important information and tries to predict the future price of a single stock. Due to the intense competition among investors, this condition makes the market price of a single stock completely represent all the things in the whole time. The latest news for UK to leave EU is weak form of efficient market.In a weak form efficiency hypothesis, price of market securities can reflect historical information, including stock prices and exchange rates , trading volume, short selling amount, financing amount and so on. In this case, investors will fail to acquire abnormal return by forecasting stock prices movements from market information in the past. This means technical analysis is no longer helpful. Nevertheless, fundamental analysis can still result in abnormal returns. It was known that Boris Johnson wanted UK to leave European Union, but yet the market did not respond until Monday.

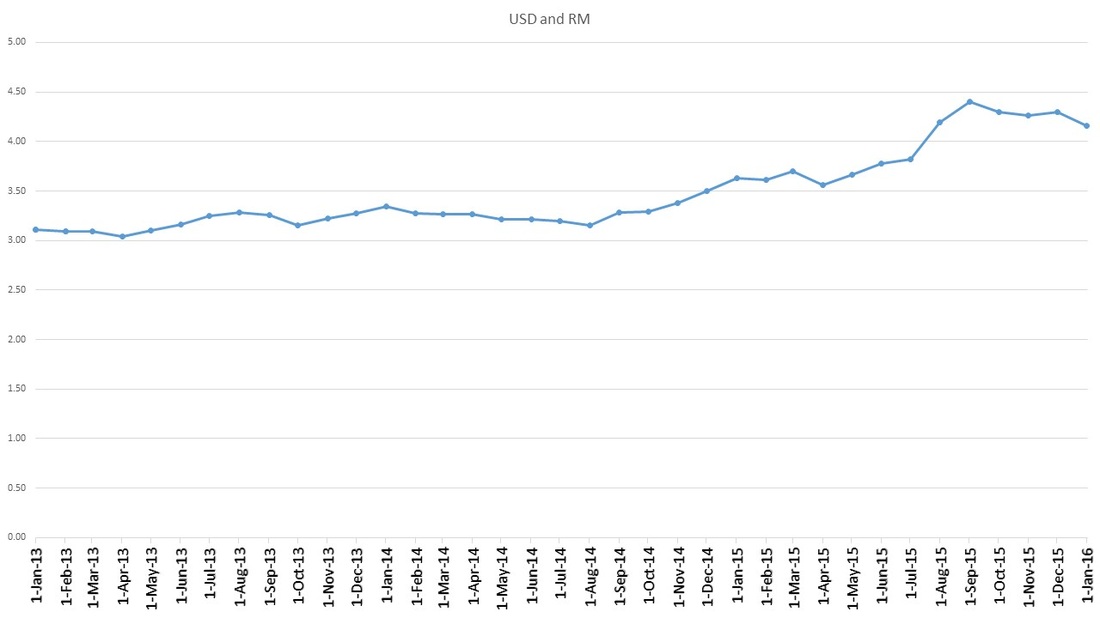

Malaysian Ringgit was strong and steady in 2012 and 2013 but then it started to lose it's value against US dollar, Euro and GBP. The biggest impact in RM was the oil price. Malaysia still heavily dependent on oil price. If we look at the graph RM started to lose it's value after April 2015. During these times when US and Europe wanted to impose sanction on Russia. US started to get their currency strong so that Russian Ruble can be weak. It was even addressed by President Obama that US made Russian Ruble weaker. What Malaysia can do is to increase the demand for RM with in Malaysia and also in internationally. One of the ways countries increase demand for their currency is by having currency futures agreement with other countries because it increases the demand for RM and also it can increase the foreign currency available in Malaysia. Reducing the Interest RateThe interest rate in Malaysia is still very high, it is above 3.2 percent, the interest rate in US and in Europe is below 0.5 percent. When interest rates are low it reduces the cost of financing, therefore it increases the demand for money. Low interest rates discourages the consumers to deposit their money because the return is low, therefore they will invest their money or spend it. In conclusion Malaysian Ringgit can go back to RM3 to 1 US dollars.

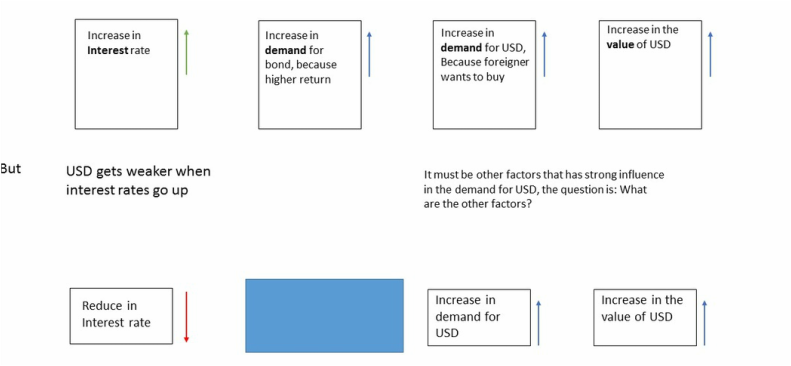

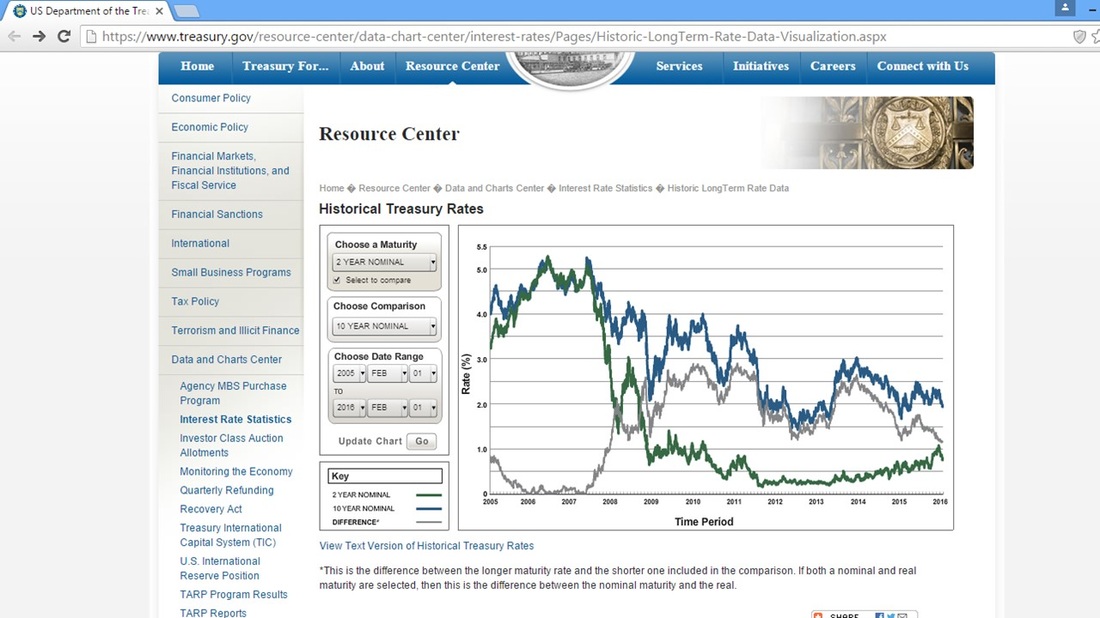

It is hard to forecast the future, even with amazing software such as Eviews, Stata or Matlab it is hard to forecast the future of the currency. In this article we will focus on what happens to bond when there is a change in interest rates and what else could impact the strength of US dollars. Impact of interest rates on Bond When there is increase in interest rates there is an increase in demand for bond because it gives higher return. High return in bond can attract foreign investors to buy bond, when they want to buy bond then they will exchange their own currency to US dollars, which will increase in demand for USD. Usually bond is purchased a lot buy investment companies and banks. Bond is risk free asset therefore high return attracts so many investors. Increase in demand for US dollar will increase the value of US dollars, therefore it will be strong against other currencies. But that is not what is happening nowadays. The interest rates are really low which is 0.5 percent and US dollar is strong against other currencies, £1 is $1.44 and it is also strong against Euro. Impact of supply in US dollar on exchange rateThe law of supply and demand states that an increase in supply reduces the price and reduce in supply increases the price. It is possible that there is reduction in supply of US dollars. Domestically, low interest rate attracts demand of money. When interest rates are low there are lot of people that wants to borrow money to finance their business or their houses. Low interest rates reduce the cost of financing, after 2008 crisis the US federal reserve bank reduced the interest rates so that people can start spending. Therefore an increase in demand locally will reduce the supply of money to rest of the world. It is less risky for the federal reserve bank to lend money locally than internationally because it reduces the risk of exchange rates. According to the US treasury after 2008 2 year nominal rates have reduced below 1 percent, this is to increase the public spending. It is monitory policy to reduce interest rates to encourage people to spend more money. When people spends more money then it helps the economy to grow.

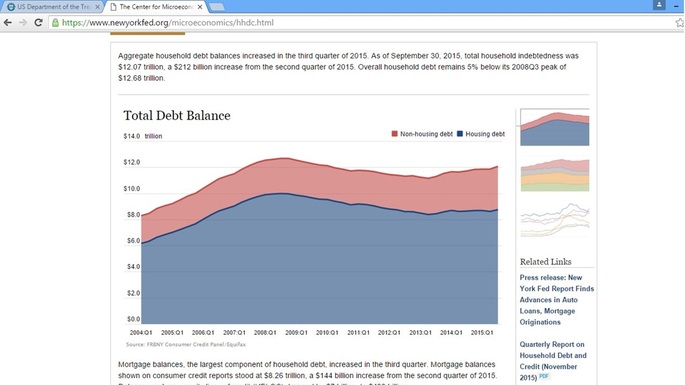

Interest rate does not have so much impact on every types of lending and borrowing. It depends on the risk level of lending, the higher the level of risk in lending the less impact of interest rate. The banks will charge high interest rate to individuals with high risk of payment regardless of the interest rate set by central bank. When interest rates goes down the commercial banks will borrow more money because the cost of borrowing becomes lower, therefore they will try to lend more money to people to finance their spending and assets. Daily spending of people are risky when economy is down and it is less risky when there is increase in economy. Usually the economy is good when people spend more money, which is why government will try to reduce the interest rate to get the economy going. You should care about interest rate if you Import and Export. If you work or have a company that imports and exports then you should care about interest rates. The companies that imports and exports usually borrows large amount of money from the bank and it is usually 3 months to 6 months borrowing depending on the product that is being imported or exported. The companies will borrow to finance their import and they will borrow to produce their goods that they want to export. The companies that exports usually will borrow long term because they are a production company. The companies that imports will borrow short term because they will make payment before the product gets to the country and then this company will distribute the products to their network. Usually one container of imported goods will be distributed within a month, it is also depending on the size of the company and size of the distribution line. When central bank increases the interest rate, then the commercial banks will also increase the interest rate on their customers, it will increase the cost of financing the import, and it will increase the cost of financing the production also. You should care if you are a consumerIt is monitory policy that the central bank will increase the interest rate to reduce the inflation rate, and they will reduce the interest rate so that the consumers can spend more money. Inflation rate is when there is an increase in price of goods, when the price of goods increase it makes it more expensive for individuals to shop for their needs. When central bank increases interest rate then you should worry about it. This does not mean that the interest rates in your credit cards will reduce, credit cards are considered are high risk credits, therefore the interest rates will always be higher regardless of the central bank interest rates. You should care if you are paying for your propertyHousing debt is considered as low risk debt, therefore the banks would be willing to give low interest rates on housing loans. These makes it more attractive for households to buy houses on loans. When interest rates are low then there is also increase in demand for houses therefore the prices of houses can also increase. You should care if you have small to medium size business According to New York Federal Reserve the non-housing debts have increased up to 3.38 trillion dollars, it shows that the lower the interest rates the higher the loans taken out. The goals of reducing the interest rate is to get the economy running that is why the central bank reduces the interest rates to reduce the cost of borrowing for businesses to run their business with less cost. What should you do if you do not want to care? Fixed rate is the best option if you do not want to worry about fluctuation of interest rates. Fixed rates are usually higher and when the interest rates drop so much then you will end up paying more for your loan.

Impact of insurance companies on the economy Impact of insurance companies on the economy Before we can understand the relevance of insurance companies on the economy, we must first understand the purpose of insurance and how it works. Insurance is a financial tool that is used to spread risk. Insurance is comprised of two main components which is the general insurance and life insurance. Falling under the general insurance category are things that are not alive, but have a significant amount of value, such as, cargo, property and automobile accidents. However, life insurance mainly covers death and medical treatment for a person. The basis of insurance is to help people during their financial distress. As we know, money can never replace lives, but it can help the lives of the people who we leave behind. Insurance gives people the financial security that is necessary for their family to survive. Personally as an individual, life insurance is the most important for the breadwinner of the family, primarily because there are a few lives that depend on them, what would happen to those lives if something happened to the breadwinner. Having insurance does not make a person richer or poorer than he already is. Given the fact that insurance can only be claimed in the event of the loss of the insured item or life, having a high amount of coverage is still not worthy to the life or item lost. But what it does is, given the circumstances, under a calamity or an unforeseen event, insurance companies would compensate for the item or life that is loss to the surviving party or rightful owner. By having such a powerful financial tool at an individual’s disposal, a person could manage his assets and expenditure in a way that allows them to protect what is most important to them without jeopardizing their future growth. As we know, the economy of a country depends on the individuals that comprise in the country such as their spending and saving behavior. Insurance companies thrives on new businesses to keep their company growing. Having new businesses or insuring more lives means that the company’s funds would grow to a substantial amount. Though all companies operate in such manner, this is more important for insurance companies because they derive coverage payouts from their funds. Therefore, the bigger the funds, the more likely they are going to survive in their industry. For a certain amount of premium paid each year, the insurance company is going to cover the insured up to a certain amount. This premium calculation is done by the company’s actuaries. Each company has a different calculation for the premiums that are to be paid to the company to bear the risk. Actuaries are required to calculate what are the risk borne by the insurance company for covering such a person or an item. The higher the risk, the more amount of premiums that has to be paid to the insurance company. With the premiums paid by the insured, insurance companies would invest the money from their funds to grow their funds in a way that would secure their company from going into bankruptcy from insurance claims. These investments made by insurance companies will be carefully placed into the equities market or commodities market to allow them to get a handsome return. From here we can see that insurance companies do two important things to the economy, one is to ensure a person or an item to allow them to have the financial freedom to pursuit the important thing in their life knowing that their family’s future is still safe. This in turn, will boost the country’s economy with trade because of the financial net that is supported by the insurance companies. Secondly, insurance companies invest in businesses and markets to generate the economy and to keep it growing. With this, it is safe to assume that the insurance industry is one of the most important pillars of the economy by giving it a strong financial net against unforeseen threats. Insurance companies have provided us with a financial tool that could help us manage what is most important to us in a way that even when we are no longer around, they would still carry on as our living legacy. By: Hafiz

|

AuthorEcon2u and others CategoriesArchives

August 2017

|

RSS Feed

RSS Feed