|

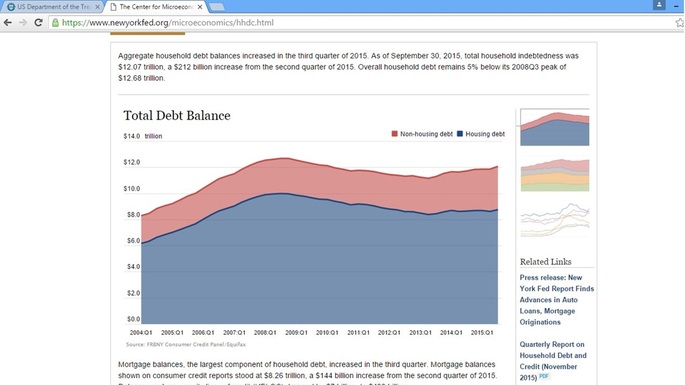

Interest rate does not have so much impact on every types of lending and borrowing. It depends on the risk level of lending, the higher the level of risk in lending the less impact of interest rate. The banks will charge high interest rate to individuals with high risk of payment regardless of the interest rate set by central bank. When interest rates goes down the commercial banks will borrow more money because the cost of borrowing becomes lower, therefore they will try to lend more money to people to finance their spending and assets. Daily spending of people are risky when economy is down and it is less risky when there is increase in economy. Usually the economy is good when people spend more money, which is why government will try to reduce the interest rate to get the economy going. You should care about interest rate if you Import and Export. If you work or have a company that imports and exports then you should care about interest rates. The companies that imports and exports usually borrows large amount of money from the bank and it is usually 3 months to 6 months borrowing depending on the product that is being imported or exported. The companies will borrow to finance their import and they will borrow to produce their goods that they want to export. The companies that exports usually will borrow long term because they are a production company. The companies that imports will borrow short term because they will make payment before the product gets to the country and then this company will distribute the products to their network. Usually one container of imported goods will be distributed within a month, it is also depending on the size of the company and size of the distribution line. When central bank increases the interest rate, then the commercial banks will also increase the interest rate on their customers, it will increase the cost of financing the import, and it will increase the cost of financing the production also. You should care if you are a consumerIt is monitory policy that the central bank will increase the interest rate to reduce the inflation rate, and they will reduce the interest rate so that the consumers can spend more money. Inflation rate is when there is an increase in price of goods, when the price of goods increase it makes it more expensive for individuals to shop for their needs. When central bank increases interest rate then you should worry about it. This does not mean that the interest rates in your credit cards will reduce, credit cards are considered are high risk credits, therefore the interest rates will always be higher regardless of the central bank interest rates. You should care if you are paying for your propertyHousing debt is considered as low risk debt, therefore the banks would be willing to give low interest rates on housing loans. These makes it more attractive for households to buy houses on loans. When interest rates are low then there is also increase in demand for houses therefore the prices of houses can also increase. You should care if you have small to medium size business According to New York Federal Reserve the non-housing debts have increased up to 3.38 trillion dollars, it shows that the lower the interest rates the higher the loans taken out. The goals of reducing the interest rate is to get the economy running that is why the central bank reduces the interest rates to reduce the cost of borrowing for businesses to run their business with less cost. What should you do if you do not want to care? Fixed rate is the best option if you do not want to worry about fluctuation of interest rates. Fixed rates are usually higher and when the interest rates drop so much then you will end up paying more for your loan.

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorEcon2u and others CategoriesArchives

August 2017

|

RSS Feed

RSS Feed