|

Sadly the economic crisis is more like a regular global event which happens mostly every 10 years. The jobs are lost and spending is reduced, it is one of the worst times for many people. Nevertheless, it is possible to hedge against the risk of losing your money and job. According to the theories of DSGE, the business cycle the economy fluctuates and it is best to take advantage when the economy at it's pick. The insurance and risk free investments are the few of the options considered in the theories of economics, however, not everyone has and access them. The majority of the individual people consider the financial instruments to invest when their personal economy at it's pick. However, during the economic crisis the price of commodities and share prices drops and therefore, the investments that was made will be lost. The saving is better than investing in stock and derivative market due to the high volatility. The currency exchange market is among the worst investment to consider, even the most experience investors cannot predict the market, due to the high influence in the actions of the government.

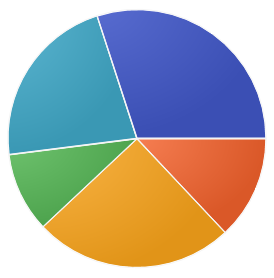

The few ways to hedge are spending time and effort on developing skills and as well as always keeping small business in the side of your carrier. During the economic crisis the companies starts to fire people to reduce the cost of the company for survival. The small business can also be costly to startup, but if it is not rushed then the cost can maintained with efficiency. Some of the economic graduates start their carrier with the small businesses in the side. In case if their carrier slows down, then during that time they can focus on their small business. During the economic crisis, the small businesses also faces difficulties during the business cycle due to reduced in spending from people. Therefore it is important to diversify your investment so that it can always have some stream of money inflow. The theory of finance where ''don't put all the eggs in basket'' is to reduce the risk by diversity. For example if the small business is online store, then the cost of running shouldn't be too high compared to normal store due to elimination of rent, therefore if you have an actual shop then diversify with the online. The online business can also be competitive therefore, consider the business that people needs it rather than wants it. The economic diversity is vital for any country in order to grow in multiple direction and as well as a good protection from the risk of economic fluctuation. Some countries are highly dependent on the single source of income, and this source of income is usually the natural resources. A good example is oil and gas producing countries, where, they are highly dependent to sustain the economic stability. The oil and gas are commodity and the price of commodities are volatile which has an impact on the economy. The stable economy is where the source of income is diversified, which can be through production, foreign direct investment and farming.

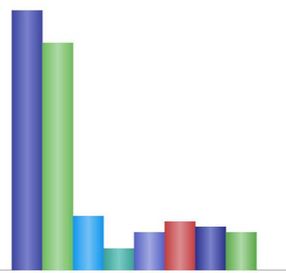

The price of coffee is another example of a commodity where economy of some countries in South America and in Africa are dependent on. According to an article by International Coffee Organization (ICO), the exchange revenue from coffee in 2008 was over 15 billion US dollars which are lower than 2004. However, the article mentions that there has been an increase in the economic diversity by coffee producing countries to reduce dependency on coffee. It was pointed out in United Nations conference on Trade and Development (2012) that it is highly encouraging for countries to diversify which will benefit in the long run for countries that are currently dependent on natural resources, it was also pointed out that diversification will reduce the vulnerability of countries from price volatility of commodity. In recent years the economy of many countries have been different, the fall in the oil and gas price had a negative impact on the economy of natural resources dependent countries. These countries have been facing difficulties in the rise of inflation and recession. These two usually happen when the countries has shortage of foreign currency, for example Nigeria and Venezuela. The increase in the demand for foreign currency will reduce the value of local currency, therefore, there will be an increase in the price of goods. The first step of increasing the diversity in the economy is by having an independent central bank, where the independent central bank will always make an efficient analysis of the economic forecast. The independent central bank will reduce or increase the interest rate to stabilize the economy. The central bank will increase the interest rate when there is an increase in inflation rate to reduce the spending. Whereas, the central bank will reduce the interest rate during recession to increase the spending. The independent central bank will reduce the interest rate to encourage the people to produce the goods locally, the local production can reduce the demand for foreign currency. The local production can also increase jobs which will reduce the recession. The second step would be increase the foreign direct investment (FDI), but the countries must be very careful in FDI, because investing in other countries will not necessarily bring a return, therefore, the investment must be made with strategy. If the country invest in another countries to increase the size of the market then that FDI is good investment because it will increase the export and increase the revenue from foreign currency. The third step would be if the local banks increases the purchase of government bonds from a foreign countries, for example of purchasing US treasury before 2008, because before the global recession the US treasury was trading with high interest rate and high coupon payment. However, after 2008 the interest rate reduced to 0.25%, which gave low yield on the bonds. In recent years the federal reserve rates have been rising steady, however the exchange rate of US dollars have been falling. Therefore, the investment in financial market is risky for the countries but it can be a long term insurance during the fall in the economy of the country. Similar to the Dynamic Stochastic General Equilibrium Model (DSGE). The impact of independent central bank on the economy in the fall of price of commodities.7/21/2017 In recent years the price of many commodities has fallen especially in the energy sector. The fall in the commodity prices in crude oil and natural gas have put the economy of many countries in a vulnerable situation. Reduction in the price of commodities reduces the economic performance of the countries that are highly dependent on natural resources. The Central Bank Independence plays an important role in reducing the impact of economic downfall of a country by observing and predicting the international economic performance. The independent central bank can reduce the interest rate efficiently rather than waiting for the instruction by the government. It is essential to understand the difference between central bank independence and monetary policy independence. The central bank independence (CBI) is when central bank of the certain country sets monetary policy independently without being influenced by the government. However, the central bank has other duties from monetary policy such as monitoring the regulations and supervising the banks. According to the lecture given by Fisher (2015) on the central bank, independence distinguished the difference between central bank goal independence and the instrumental independence in detail. Reduced interest rate by the independent central bank can stimulate the production within a country which can reduce the dependence on an imported goods and services. An independent central bank can reduce the interest rate by keeping stable inflation rate which would rise from a shortage of foreign currencies which is earned from selling natural resources. The earning from export reduced for countries that are highly dependent on the price of commodities. The quantity demanded are still the same but due to high quantity of supply the price of the gas and oil reduced. The price of coal has also reduced due to a reduction in the alternative goods. The countries that are highly dependent on natural resources are selling at the same rate but the returns have reduced due to the low price. Reducing the interest rate by the central bank will reduce the cost of borrowing, which stimulates the production of goods and services within a country. The countries that are highly dependent on natural resources will find an alternative way to increase the production by reducing the interest rate. The fall in the price of oil and gas in 2015 has a direct impact on oil and gas producing countries such as Nigeria, Qatar, Malaysia and Saudi Arabia.

The understanding of economics is vital regardless if you are a startup company or if you have a company. The economy has a great impact on the performance of a company, when the economy is going well the company is more likely to do well, whereas, if the economy is in a recession then the company is more likely to struggle. The understanding of economics can help the companies to take precaution to avoid distress when the economy is at its lowest point.

When the economy is peaking When the economy is at peak it is best to have precautionary savings for the company or make use of the economic peak to diversify the companies market and business. The diversification of the market can help the company to sustain during an economic recession within a country. If the company is doing well in Country A then it is most advisable to expand the market to Country B so that when the economy of Country A is in a recession the income from Country B will support the losses. The diversification of business can help the company to sustain when one business is doing bad the other business might do well during economics downfall. When the economy is at its peak most the people have jobs, therefore, they have disposable income to spend on the things they desire. Whereas during the recession the unemployment rate is high, therefore, most of the people do not have enough income to spend. Therefore, it is best to take advantage of the economic peak rather than ignoring that the economy will not remain at peak. When the economy at recession When the economy at the recession, there are not much can be done but to survive the recession, during economic recession multinational companies can survive the recession but during a global recession then even the multinational companies have less chance of surviving. If the recession is within a specific country then it is best to increase the export to other countries. In a recession, the government usually reduce the tax to boost the economy, therefore, it is best to take the opportunity to export. The local market does not have enough disposable income for spending, therefore spending is low during the recession. The economic downfall usually encourages the employees to work hard to keep their job, this can also be taken into an advantage by increasing the quality and efficiency of the production. An increased quality of product and services are in high demand in international level. Conclusion The companies that are at peak should take advantage of the extra cash for sustainability of the company by taking the projects are that have positive NPV. Some of the companies with extra cash take bad projects with an ambition in expanding the company.

Rule of the markets

Minimal government

Forex rates and markets Monetary policy and Quantitative easing

ConclusionFriedman also influenced other fields that have an impact on the economy like education and military policy. Many aspects of free markets and attendant government regulations today can be attributed to the works of Friedman.

The Economy have changed since 2008, when the inflation rate was high the central bank used to increase the interest rate to reduce inflation rate, where people would save their money instead of investing or doing business to get a high return on interest. People used to investor start-up business when the interest rate was low because the cost of low cost of borrowing. The interest rate could be understood well by using Taylor Rule by John Taylor.

These questions can give better understanding of the current economy:

The Fed reduced the interest rate to 0.25 percent after the 2008 global economic crisis, since then the central bank of developed countries have reduced the interest rate close to zero or even to negative interest rate. Why did they reduce the interest rate to close to zero? Reducing the interest rate to close to zero increases the economic activity and increases the production. Low-interest rate means low cost of financing the business. What is the macroprudential policy? Macroprudential policy is to ensure the stability of financial health of an economy. How will macroprudential policy foster financial stability? The financial stability can be achieved through macroprudential instruments which are:

Is it here to stay for the long term? Yes, macroprudential policy is here to stay for long term maybe even permanently. Is low-interest rate good for the banks? Low-interest rates have some advantages for the banks, but one of the biggest advantages is it allows banks to obtain loans at a low cost. Is low-interest rate bad for the banks? Yes and No, for the answer yes was answered above but for the answer no is: The low-interest rate means that banks have a lot of money that they can’t use due to restrictions by macroprudential policies. The low-interest rate is meant to reduce the cost of financing but it actually increases the cost of holding so much money for the banks. The banks increase their revenue by giving loans to customers but due to the restrictions by macroprudential instruments, the giving loans become harder for the banks. One of a good example is Liquidity Coverage Ratio (LCR) where banks have to have 100 percent or more of the deposits over the period of 30 must be held by the banks, that means the short term depositors are a cost for the banks. Another example is Liquidity risk charges where banks get penalized for short-term funding or leverage ratio where banks have to maintain low leverage ratio. Do banks earn money from Bond? This is where it gets interesting when the interest rates fell the banks cannot make money through selling bonds, because not many people are interested in buying bonds, therefore, the demand for bonds have fallen. Think about it, the why would investors buy bonds that give only 0.25 percent return where they have to keep their money for a long period of time. Short-term bonds are still understandable but long term bonds such as 5 years to 30 years maturity are hard to attract investors with a low-interest rate. If the banks bought government bonds then they are highly likely that they will keep those bonds because they will still be getting their returns at the high-interest rate when it was issued. What are the alternative solutions? It is hard to give suggestion but the large banks have branches all around the world and not all the countries have implemented low-interest rates and macroprudential policy. The banks should make some research on the countries with high-interest rates and try to diversify their business to those countries with high-interest rates, that way they can obtain the low cost of capital and earn the higher interest rate. Like what Milton Friedman said, "in an economy, both parties can gain, it does not mean one has to gain and another has to lose". Are we going to have another global crisis? If I knew that I would be so rich, but actually even if we knew it, we wouldn’t be able to do anything about it due to our ignorance. It has been talked a lot by many people if we are going to have a global crisis again, well most of the countries are already seeing economic fall due to a reduction in the price of crude oil, natural gas, and coal. It is hard to tell if European and US economy will have an economic crisis because they have always been the buyers of the oil and gas and low cost these commodities reduce their cost of buying these commodities. The number of businesses in private sector is growing every year in United Kingdom, according to fsb.org.uk there were 5.4 businesses registered in UK which grew by about 2.7% from 2014. These are the list of top 3 economic reasons why businesses fail, based on our finding from other resources. CompetitionIn perfect competition there are a lot of businesses that offers identical products and services. Higher the number of companies register the higher the competition. According to gov.uk the problem in market sector is when market is working well companies compete by offering cheaper and better product to their customers. Fail to pay taxAccording to simplybusiness.co.uk one of the reasons why businesses fail in UK is because they are unable to pay taxes. It is highly likely that most companies are unable to pay their tax on time and according to Simply Business the firms should HMRC immediately when they are having difficulties in paying their tax. BudgetAnother economic reason why businesses fail in UK is due to the lack of enough budget. According to the intuit.co.uk 29 percent of the small business failure is due to not having enough cash. Based on an article published at telegraph.co.uk the businesses fail due to lack of banks lending. The companies likely to fail with small budget and when there is limitation in borrowing money from banks to finance the operation of their business.

Stable economyMalaysia is open economic country with stable economy. According to World Bank Malaysia has the largest economy in South East Asia with the growth of over 7 percent per year for over 25 years. Based on the 2016 report by heritage.org the freedom score increased by 0.7 points with new score being 71.5, it makes Malaysia 29th in Global Ranking. The corporate tax rate in Malaysia is 25 percent and income tax rate is 26 percent. Skilled employeesMalaysian education is among the top around the world, the quality and affordability of education is one of the greatest contributors for skilled employees in Malaysia. In 1997 the government established government loan called Perbadanan Tabung Pendidikan Tinggi Nasional or in short it is know as PTPTN loan. The loan is made by the government with 1 percent interest per annum and every Malaysian who wish to study should not be denied to get a loan due to financial background. This loan encourages Malaysians to study and be educated employees. Malaysia is among the best countries in terms of skilled employees and it makes it ideal location to invest and conduct business. TechnologyThe technology is one of the main exported goods of Malaysia, according to OEC the 12 percent of Malaysian export in 2014 was Electronic Microcircuits, 1.8 percent was computers and 1.9 percent was computer parts. The electronics such as computers are essential in conducting business and these products are relatively cheap in Malaysia and it helps the investors to reduce cost in their initial startups. There are other technologies available to export from Malaysia the quality of Malaysian products are considered favorable around the world. Cost efficiency

The current interest rate in Malaysia is 3.25 percent and the inflation rate is at 3.5 percent, if Bank Negara Malaysia or Central Bank of Malaysia reduced the interest rate the inflation rate would increase in Malaysia. In an economy when there is too much money the inflation rate increases, reduction in interest rate will discourage from depositing and it will encourage in borrowing. The low interest rate reduces the cost of borrowing due to this most of the people will finance their cars, houses, businesses and investments by borrowing money from the bank. The interest rate is relatively low in current economy of US and Europe, but the central bank put restriction on Banks in lending money, that is why the inflation rate is low even that the interest rate is low. The central bank of US and other developed countries control the banks through Macroprudential policy. Why would inflation rate increase if Bank Negara Malaysia reduced interest rate?The inflation rate will increase if Bank Negara Malaysia reduced interest rate because they would be too much money in the economy of Malaysia. For many years Malaysian government has been battling with high inflation rate that is why they have been giving subsidiary in petrol, utility and other things. If the central bank of Malaysia reduces the interest rate then there will be an increase in inflation rate, but if the central bank of Malaysia also introduces Macroprudential policy then they will be slowing down of output. The restriction on banks to give loans to consumers and businesses will reduce the output because most of the people finance their houses and cars through bank loans. The current interest rate of Malaysia is in optimal point and it takes time to reduce inflation rate.

Most people dream of owning their own company, but there is fear in many people to start up their company because of risk factors. According to gov.uk in UK there are about 3.4 million active registered companies, whereas in Europe there are over ten million registered companies. Many people have great ideas and knowledge to start up their company and as well as to make it successful but even then there are many companies that fail. There many other reasons why businesses fail but this article focus on the economic reasons. It is hard for the companies to manage the economic activities because they cannot manage or control the monetary policies and fiscal policies. Increase in TaxAn increase in tax forces the companies to increase the price of their goods which results in reduction in sale. The reduction in revenue will forces the company to reduce wages and the number of employees in the company to reduce cost. If their sale keeps declining then these companies will not be able to bare the cost of running the businesses, which will force their business to fail. Increase in Interest RateWhen central bank increase interest rate then it increases the cost of borrowing, these are directly effected by small companies because they depend on taking loans to operate their businesses. It also has an impact on the big companies because their employees will have to pay higher interest rate on their mortgage which will reduce their disposable income. Reduction in disposable income will reduce the sale for many companies, which will force their business to fail in the long run. Export and Import PoliciesHigh export duty is not advisable for most of the countries because then these companies also have to pay import tax in another country which will increase the price of their products, that way they will have low sale. High export tax reduces the market size of the businesses therefore they will depend on the local market. It puts barriers for them to expand their businesses where in long run their business will fail because of an increase in competition. Import duty is very hard for the government to set, because reduction in import duty will increase in imported goods which will increase the competition for local businesses. Increase in import duty will also course the businesses to fail because there many import companies. UnemploymentBusinesses fail because of high unemployment in economy. If people do not have a job then they will not have any income, when people do not have money to spend, therefore businesses will not be able to sell their products and services. They will shut down their company because of low revenue, they will not be able to pay the salary of employees and other expenses.

|

AuthorEcon2u and others CategoriesArchives

August 2017

|

RSS Feed

RSS Feed