|

Not everyone is blessed with a good supervisor or a boss, but some of the bad supervisors or bosses have horrible ways of reducing the quality of work performed by employees. These are the top two habits of horrible bosses.

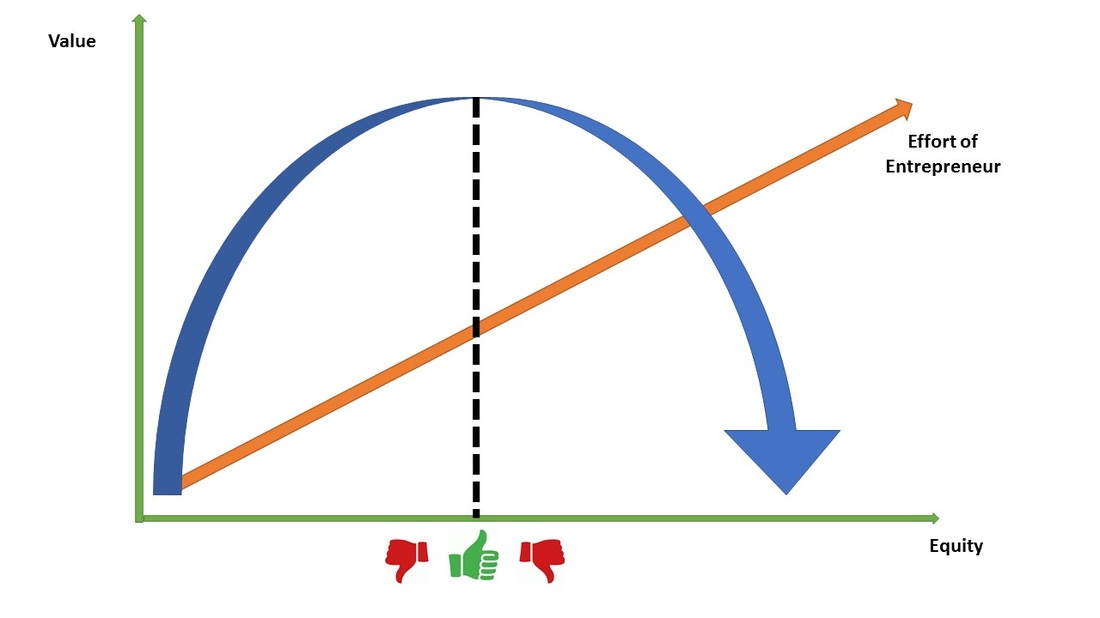

Putting pressure every day over small things is a bad habit of a bad boss It is normal to put pressure on the employees when there are deadlines, or it is also normal to put pressure on lazy and inefficient employees but it is not good to put pressure on employees every day and constantly over small things is a bad habit of a bad boss. Devaluing employees is another bad habit of a bad boss If you have a boss that does not say good things about you then you are lucky, because there are some bosses that say so many negative things to their employees. Some bosses or supervisors treats their employees badly when there is a guest in the office to show off to their guest. These things might sound childish but it happens a lot in many countries. Devaluing employees is a very bad habit of a bad boss, especially the employees that contributes so much to the company. The best thing to do is to be a team player and appreciate the hard work and contributions put by the employees rather than constantly devaluing them. Level of Equity ownership will have an impact on the Venture Capitalist and Entrepreneur

Optimal level of ownership is the best for venture capitalist and entrepreneurThe ideal level of ownership is optimal level of ownership which is 50% for both parties. In real life it is much more complicated than this because there are more than one owners of equity in the team of entrepreneur which they can come to disagreement anytime and they can also reduce their level of effort if as an individual does not have enough ownership.

Venture Capital Supplies over $100 thousand to millions vs few thousands of dollars supplied by SponsorVenture Capital gives support other than money vs no support by Sponsor other than moneyVenture Capital wants share of equity vs Sponsor wants to give support in terms of moneyIf you want to turn your idea in to an established company then Venture Capital is the way, because they know how to establish a company.

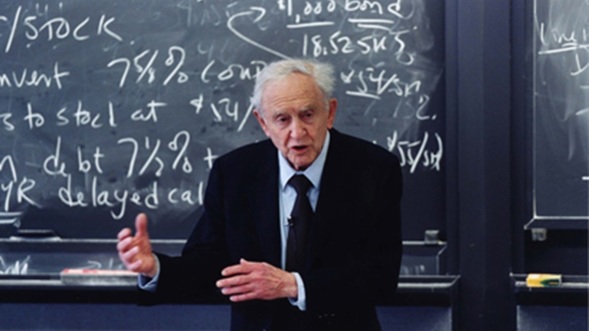

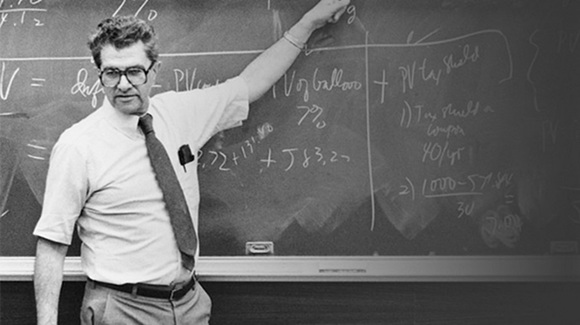

These are the list of top contributors to modern Finance. Franco Modigliani - Capital StructureFranco Modigliani and Merton Miller are the biggest contributors to modern capital structure. They published The Modigliani-Miller irrelevance theorem in 1958, and in 1961 dividend theorem and in 1963 new version of capital structure theory with tax. Merton Miller - Capital StructureMerton Miller worked with Franco Modigliani and together published Modigliani and Miller 1958 Irrelevance theorem , Modigliani and Miller 1961 Dividend Policy theorem and Modigliani and Miller 1963 Cost of Capital. William Forsyth Sharpe - Capital Asset Pricing ModelAs a finance student you must definitly know what is Capital Asset Pricing Model or another words CAPM. William Forsyth Sharpe is the inventor or founder of CAPM. Stephen Ross - Arbitrage Pricing TheoryThe Arbitrage Pricing Theory (APT) was first originated from Stephen Ross in 1976, APT is widely taught in Finance and it is among the most important theories in modern finance. Eugene Fama - Efficient Market HypothesisEugene Fama is considered as the father of finance and he is well know for Efficient Market Hypothesis (EMH). He is also best know for modern portfolio theory.

The current target federal funds rate is in between 0.25 to 0.5 percent but could Fed impose negative interest rate in US? According to the article publish by fortune.com the Chair of the Board of Governors of the US Federal Reserve Janet Yellen mentions that they will not ignore on ruling out the negative interest rates. But there must be a lot of research that needs to be done before it could be practiced in the U.S. The original goal of Fed is to increase the interest rate slowly to achieve the 2 percent inflation rate target and economic growth. By: Max |

All the articles are short and random.

Archives

August 2017

Categories |

RSS Feed

RSS Feed